Looking at your past transactions will save you money. Looking for cashier errors, or an unexpected car tax excise. Sensei will guide you.

First things first, you need the raw materials – your transaction history. Most banks and credit card companies offer online tools or downloadable statements. Gather all your spending data, from debit card swipes to ATM withdrawals, for the past 30 days.

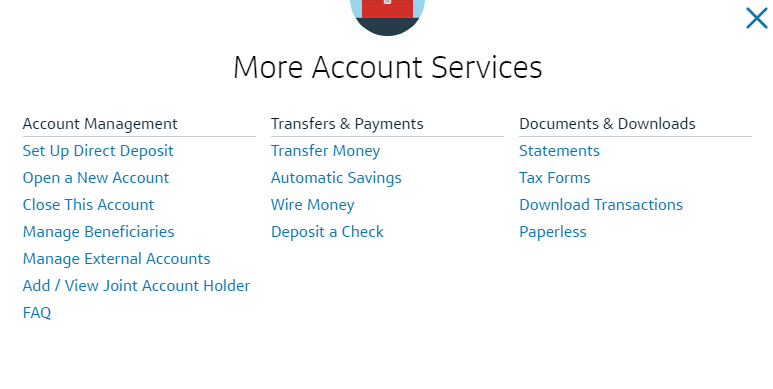

Everyone’s bank is different, so whichever one you have, try to follow along. Once you login, select the credit, debit, or checking account, the one you want to review, find out how to download your past 30 days into a spreadsheet file, it should look like this:

For Capital One: More Account Services> Download Transactions>File type:CSV>Last 30 Days

CSV File is for spreadsheets conversion, open that file with Excel or Google sheets.

Gather Your Data

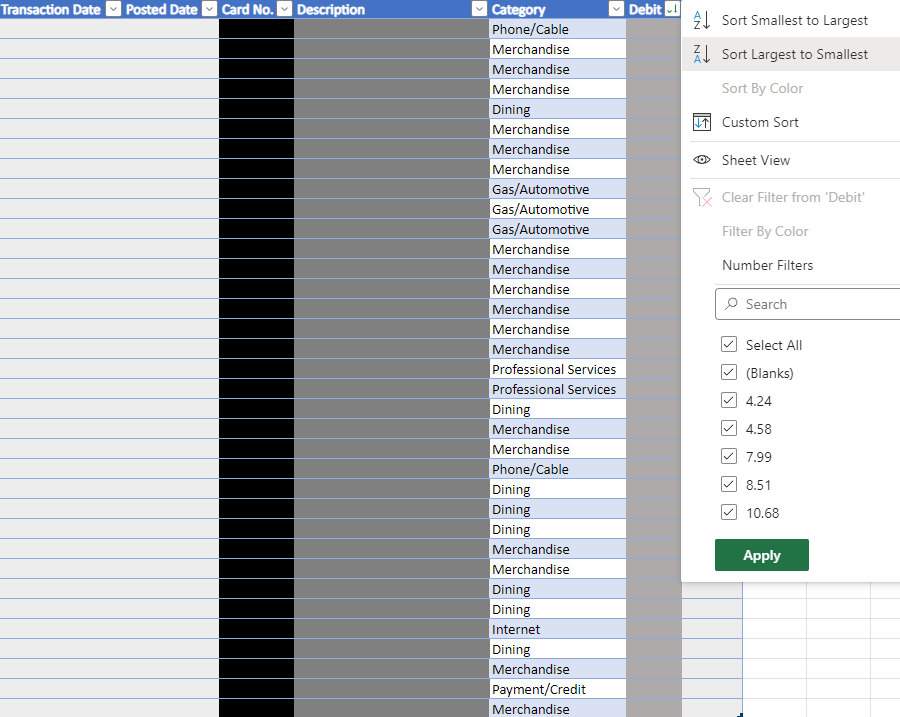

Once your transactions info is into the sheet we will call it data, it may look a little unorganized, if you see ########, open the columns, after organizing, before we can manipulate the data, select all of the data and insert a table.

Categorize Your Expenses

Now comes the fun part – organizing the chaos! Categorize your expenses.

- Essentials: Rent/mortgage, utilities, groceries, transportation.

- Debt Payments: Minimum payments on loans and credit cards.

- Savings: Contributions to emergency funds or retirement accounts.

- Discretionary Spending: Entertainment, dining out, shopping, subscriptions.

There’s no one-size-fits-all system. Look for errors, some business may charge twice on accident, call them and they will promptly refund. Do you see a subscription you haven’t used in months? Some companies may even refund the full amount if you truly didn’t use the service, they can check.

Tools for the Journey: Spreadsheets or Apps

Technology is your friend! Even a simple spreadsheet can work wonders. List your transactions with categories and amounts. Seeing the numbers adds a powerful visual impact.

Exploring What you can do with a table of data

Now, the real adventure begins! Analyze your spending patterns. Look up how to make a pivot table and manipulate data. Where’s your money going? Are there any surprise budget busters? Did you stick to your goals, or did that daily latte habit derail your plans? Do you have a question you want Sensei to cover?

Facing Identifying Areas for Improvement

No map is perfect, and every adventurer encounters unexpected turns. Did you discover hidden spending traps? Maybe those daily lattes added up faster than you realized and Car expenses add up quick. Now’s the time to identify areas where you can adjust your spending habits.

Setting Goals

Armed with your financial map, set goals. Don’t expect to become a budgeting ninja overnight. Start small. Maybe cut back on eating out once a week or unsubscribe from a rarely used streaming service. Every saved dollar is a step towards a brighter financial future.

Tracking Progress is Key

This isn’t a one-time expedition; it’s an ongoing journey. Regularly revisit your transactions, track your progress, and celebrate small wins. Did you stick to your goals this month? Did you manage to save more than last month? Acknowledge your successes, and move on to new goals.

The ultimate goal is to create healthy financial habits that stick.

The Treasure at the End of the Journey: Financial Security

Reflecting on your past 30 days of transactions is an investment, not a chore. It’s a powerful tool that empowers you to take control of your finances. By understanding your spending habits and setting realistic goals, you’ll be well on your way to achieving financial security. Remember, Sensei is just a guide; you are the warrior, charting your course towards a brighter future.

Additional Tips:

- Talk to a Financial Advisor: Seek professional guidance for personalized financial planning. Different places offer them for free, Libraries, Large companies, the Internet, etc.

- Automate Your Finances: Set up automatic transfers to savings or retirement accounts. “Pay yourself first” is a golden rule.

- Embrace the Power of “No”: Learn to politely decline unnecessary purchases.

Leave a Reply